It i is an easy and convenient way to transfer money online to your family or friends, etc. in India.

This facility is available to all current account holders of ICICI Bank Singapore.

Currently the below mentioned transaction limits apply. The limits are per day per remitter

Minimum amount - SGD/USD100

Maximum amount - SGD/USD 25000

Notwithstanding the above mentioned daily transaction limits as applicable per remitter per day, the overall use of the International Money Transfer Facility is subject to certain daily limits on the value and/or volume of transactions permitted as per internal operational guidelines ("overall operational limits") of ICICI Bank Singapore Branches. ('ICICI Bank').

ICICI Bank may at any time change the overall operational limits at its own discretion. In the event these overall operational limits are reached in a given period of time the use of the International Money Transfer Facility shall be temporarily unavailable and you will be notified by an appropriate message while placing a request for a transaction on the website.

ICICI Bank shall not be liable for any rejections, queries or delays arising due to such temporary unavailability of the International Money Transfer Facility.

In the event of such temporary unavailability of the facility, you can walk in into a branch of ICICI Bank, or if you are a current account holder of ICICI Bank, you can use our 'Call & Remit'* facility to carry out your remittance request.

*terms and conditions apply. For more details, please visit our branches

For using the International Money Transfer facility, you need to have

- A current account with ICICI Bank Singapore Branch ("Branch") with

- Internet banking access

- Onekey device

- Mobile number registered with the Branch

If the above requirements are complied with, you would be able to use the facility subject to applicable Terms and Conditions.

Beneficiary account held with ICICI Bank of Any other bank participating in NEFT clearing in India: funds will be transferred on the same day subject to cut off timings*. (If the funds are being transferred to any of the 75,000 RTGS / NEFT branches of over 100 banks in India, the funds will be credited into the beneficiary's account by the beneficiary bank. The Branch will disburse the funds on the same day)

*Same day fund transfer is subject to cut off timings, presently 4 PM (subject to satisfactory completion of and compliance with the Bank’s standard procedures).

This facility allows you to transfer money electronically to your beneficiary's account in India. The network covers more than 75,000 branches of over 100 banks.

The beneficiary would have to be pre registered online for using this facility wherein you would be required to provide and complete the details of the beneficiary like:

- Beneficiary Name

- Beneficiary Account number

- Beneficiary Bank Name

- Amount for transfer

- Complete address of Beneficiary

- Date of Birth of Beneficiary

- Relationship with remitter

There is no additional charge for using the Direct Credit facility. Please refer to Rates and Charges for Money Transfers, available on the website (www.icicibank.com.sg) and at the Branch.

Currently FREE upto 31st March 2019.

Please note ICICI Bank has no control where the other banks (beneficiary's bank, other than ICICI Bank Limited, India) deducts any additional service charge or puts funds on hold for non-payment of any such charges.

If you do not have an account with the Branch, please visit one of our branches in Singapore with the following documents: Complete and print the application form for Money Transfers and Please carry the following documents, as applicable:

- NRIC/EP/WP/SP/PEP for residents of Singapore

- NRIC and Passport for non-residents of Singapore

- Passport and ID (as applicable) for non-permanent residents of Singapore

- Address proof: Original of a utility bill or a bank statement received in the past three months

If you have any questions or queries, please call us on our ( local Toll Free) number at 8001012553 or from overseas(65) 67239009 (call charges may apply), between 0800 - 1800 hrs, 7 days a week for further details.

The Branch offers International money transfers:

- • Same day to over 2500 branches of ICICI Bank in India.

- Same day # to 75,000 branches of other 100 banks in India.

- Competitive exchange rate

Standing Instruction - A 'Standing Instruction' (SI) allows accountholders to schedule regular fund transfers from their ICICI Singapore current account to designated beneficiary account(s) in India. By pre-scheduling the time and amount of a transfer, you can ensure that you would never miss an important fund transfer again! - Rate Block - This feature allows you to set your ideal currency conversion rate for your online money transfer transaction. Simply input a Minimum Exchange Rate of your choice for carrying out a transfer, and the transaction will automatically be processed only when our exchange rate reaches or becomes higher than your pre-set Minimum Exchange Rate. If your pre-set exchange rate is not reached within 15 days of setting up the Rate Block, your money transfer transaction will be cancelled until you are ready to set a new rate

*Same day fund transfer is subject to cut off timings, presently 4 PM (subject to satisfactory completion of and compliance with the Bank’s standard procedures).

A 'Standing Instruction' (SI) allows accountholders of the Branch to schedule regular fund transfers from their ICICI Singapore current account to designated beneficiary account(s) in India. By pre-scheduling the time and amount of a transfer, you can ensure that you would never miss an important fund transfer again. Following are the important aspects of a Standing Instruction :

- A Standing Instruction will be processed on the date for which it has been scheduled, depending on the frequency of transactions and number of payments set. The transfer may be taken for processing anytime during the day

- The processing date under various frequencies (every 7 days, every 15 days, every month, every 2 months, every quarter, every 6 months) will be calculated as below:

- Every 7 days - Next due date will be calculated as the 7th day from the last due date e.g. Standing Instruction set on 30/01/2011, will have due dates as: 30/01/2011, 06/02/2011, 13/02/2011, 20/02/2011, 27/02/2011, 06/03/2011 (if its not a leap year; next due date will be 05/0 3/2011 if it's a leap year)

- Every 15 days - Next due date will be calculated as the 15th day from the last due date

- Every month - Next due date will be calculated as same date of next month e.g. Standing Instruction set on 10/01/2011,will have due dates as: 10/02/2011, 0/03/2011 etc. Standing Instruction set on 31/01/2011 will have due dates as 31/01/2011, 28/02/2011, 31/03/2011, 30/04/2011 etc. Next due dates will be calculated similarly for every 2 months, every quarter and every 6 month frequencies

- Standing Instructions will be executed at the exchange rate applicable at the time the transaction is processed. The rate applied may/ may not be the highest exchange rate for the day Standing Instructions may be set in SGD or INR. A request set in SGD will define the exact amount to be debited from your Account. A request set in INR will define the exact amount to be credited to your beneficiary's Account in India. For instructions in INR, the amount debited from your Account will be determined by the INR-SGD exchange rate up to five decimal places

- For requests set in INR, equivalent SGD amount will be calculated on the applicable exchange rate and debited from your Account, subject to the daily online transaction limit

- Standing Instructions will not be processed if your Account does not have sufficient cleared balance, or You have utilized all the daily online transaction limits (cumulative of all transfers processed on the day), or there is a system failure. The status and details of your request may be viewed on the transfer history page of your internet banking (link available on your internet banking, which displays history of your transfers to India)

- Where you have multiple and varying transactions scheduled on a given day, any one or more may get rejected. The cumulative sum of the transactions scheduled on a given day will be matched against the daily online limit and the funds available in your account

- In case a Standing Instruction transaction has failed, the next due transaction will be processed on the scheduled date. The failed transaction will also be counted in the total number of payments set for the Standing Instruction

- Status of various Standing Instructions set by you may be viewed on the 'Manage Standing Instructions' page of your internet banking

- A Standing Instruction will be automatically deleted in case the beneficiary to whom it has been set is deleted

This feature allows you to set your ideal currency conversion rate for your online money transfer transaction. Simply input a Minimum Exchange Rate of your choice for carrying out a transfer, and the transaction will automatically be processed only when our exchange rate reaches or becomes higher than your pre-set Minimum Exchange Rate. If your pre-set exchange rate is not reached within 15 days of setting up the Rate Block, your money transfer transaction will be cancelled until you are ready to set a new rate.

- A rate block request may be defined for a period not exceeding 30 days.

- A rate block request will be processed on a date falling during the period defined, in case the actual exchange rate meets/crosses the desired exchange rate set by you. If the desired exchange rate is not met during this period, the rate block request will get cancelled. All updates in the actual exchange rate during a day will be validated against the desired exchange rate. For example, if the rate desired by you is 40.00, and:

- The actual exchange rate is 40.00, your transaction will be processed at 40.00

- The actual exchange rate is 42.20, your transaction will be processed at 42.20

- The rate block request will be executed at the actual exchange rate applicable at the time the transaction is processed, which may be equal to or greater than the desired exchange rate set by you. The applicable exchange rate will be inclusive of all promotional offers (if any) valid at the time of processing.

- A rate block request may be set only in SGD, defining the exact amount to be debited from your Account

- Rate block requests will not be processed if your account does not have sufficient cleared balance, or You have utilized all the daily online transaction limits (cumulative of all transfers processed on the day), or there is a system failure. The status and details of your request may be viewed on the transfer history page of your internet banking (link available on your internet banking, which displays history of your transfers to India)

- Where you have multiple and varying transactions scheduled on a given day, any one or more may get rejected. The cumulative sum of the transactions scheduled on a given day will be matched against the daily online limit and the funds available in your account

- Status of various rate block requests set by you may be viewed on the 'Rate Block' page of your internet banking

- A rate block request (which is in 'Pending' status) may be deleted at any time during the period set as long as it is in 'pending' status

- A rate block request will be automatically deleted in case the beneficiary to whom it has been set is deleted

If you have any questions, please contact us on our (Toll Free) number at 8001012553 from overseas(65) 67239009 (call charges may apply, between 0800 - 1800 hrs, 7 days a week.

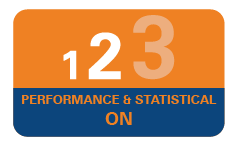

SMS OTP is a One Time Password/ unique reference number (URN), which will be sent to you via SMS to your mobile/ handphone registered with us each time you login .The One time password is valid for a 100 second time-window only.

For fund transfer or money transfer to India you would need the Onekey device for transaction signing

You will need the Onekey device for addition of beneficiary and remitting funds to India Depending upon the amount the transaction signing will vary as follows-

| S.no | Transfer Amount | Type of verification applicable |

|---|---|---|

| 1 | From 1 to 2000 | Onkey device based OTP |

| 2 | Greater than 2000 and less than 25000 | Transaction signing password using Onekey device with one input parameter |