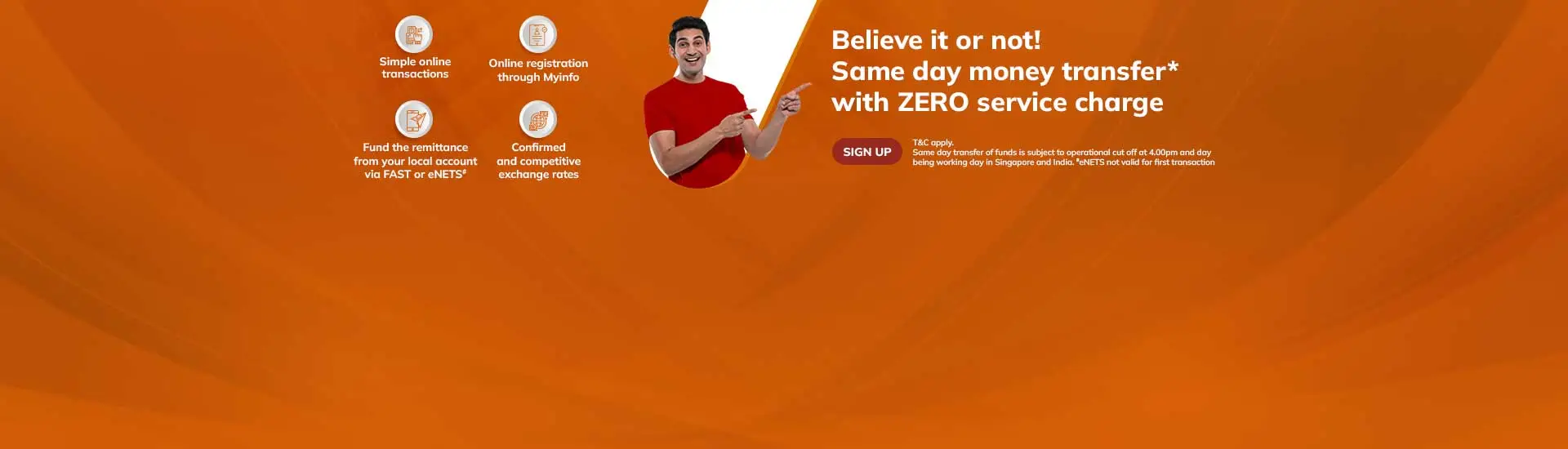

M2I Benefits

- Simple, easy and convenient online transactions

- Online registration through Myinfo

- Fund the remittance from your local account via FAST

- Confirmed and competitive exchange rates

How does it work

- Create your profile by registering one time

- On successful registration add beneficiary details and your bank details

- Create and fund your transaction via FAST

Charges

Service Charges- No service charges for a limited time only

FAQs

- What is the daily fund transfer limit?

- When will the beneficiary get credit in India?

- User ID and password related Questions

- How can I reset my Money2India password?

- I am getting a message that my User ID had been disabled? What do I do next?

Scroll To Top